As the crypto space continues to evolve, 2025 presents more opportunities than ever for investors to earn passive income through blockchain technology. Whether you’re a beginner or a seasoned HODLer, building a crypto income stream doesn’t require trading all day or taking high risks.

1. Staking

Staking remains one of the most popular ways to earn crypto passively. By locking up your coins on proof-of-stake (PoS) blockchains, you help validate transactions and, in return, receive rewards.

Best Networks to Stake in 2025:

Ethereum 2.0, Cardano, Solana, Polkadot, Avalanche

Average Returns: 4% – 12% annually

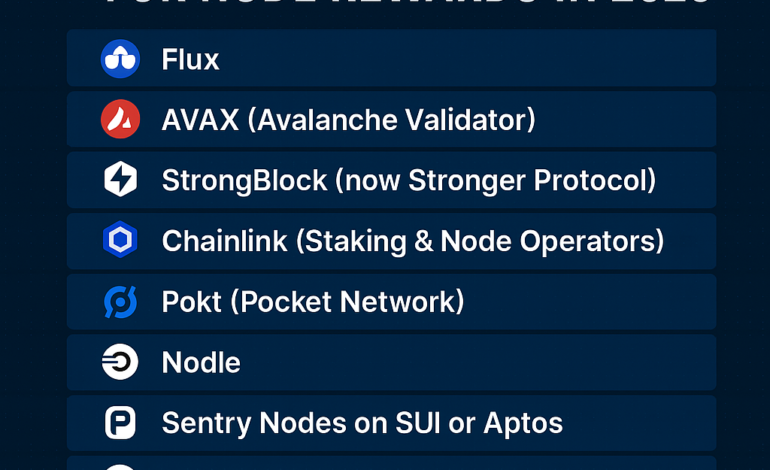

2. Running a Node

Running a full node or validator node can offer higher returns than staking—especially if you’re supporting newer or smaller blockchains. It requires more technical knowledge and infrastructure, but the rewards are often worth it.

Popular Node-Based Projects:

Flux, StrongBlock, Ethereum Validator Node, AVAX Validator

Returns: Variable, depending on uptime and network activity

3. Liquidity Mining (Yield Farming)

Provide liquidity to decentralized exchanges (DEXs) like Uniswap or PancakeSwap and earn rewards in the form of trading fees and bonus tokens. In 2025, newer chains like Base, zkSync, and Sui are offering lucrative liquidity incentives.

Watch for: Impermanent loss and smart contract risks

Estimated APY: 5% – 50% (depending on token pair and DEX)

4. Crypto Lending

Platforms like Aave, Compound, and Venus allow you to lend your crypto to others and earn interest. In return, you receive a stable yield with relatively lower risk.

Top Lending Platforms:

Aave, Compound, Venus, JustLend

APY: 3% – 10% depending on asset

5. DeFi Aggregators

These tools auto-optimize your yield across various DeFi protocols, saving you the effort of managing farms and pools.

Popular Aggregators:

Yearn Finance, Beefy Finance, AutoFarm

Why it works: Compounds your earnings automatically and finds best returns

6. Airdrops & Retroactive Rewards

Participating early in DeFi or Web3 projects can lead to huge airdrops. By interacting with testnets or beta versions, you can qualify for token distributions down the line.

2025 Tip: Watch upcoming Layer 2s and ZK-rollups for future drops

Effort level: Medium (you need to perform certain tasks or interactions)

7. Crypto Savings Accounts

Platforms like Nexo, YouHodler, and Binance Earn offer fixed or flexible savings accounts that generate interest on your holdings.

Supported Assets: BTC, ETH, USDT, USDC, and more

Annual Returns: 5% – 12%

Important: Always choose platforms with a strong reputation and risk management

8. Play-to-Earn (P2E) & Move-to-Earn (M2E)

Although the hype has slowed, certain gaming and lifestyle dApps still offer solid passive income opportunities through NFTs and in-game staking.

Trending in 2025:

Stepn, Illuvium, Gala Games Ecosystem

Returns: Game-dependent; some offer passive staking via in-game assets

9. Real-World Asset (RWA) Tokenization

Platforms now tokenize real-world assets like real estate, bonds, and art—allowing users to earn passive income through fractional ownership.

Examples:

RealT, Goldfinch, Tangible

Yields: 5% – 15% depending on the asset

10. Affiliate & Referral Programs

Many platforms offer crypto rewards for bringing in new users. While not purely “passive,” once set up, referral links (e.g., on your website or YouTube channel) can generate consistent rewards.

Top Crypto Referral Programs:

Binance, KuCoin, Nexo, Ledger

Pro Tip: Combine this with educational content to increase trust and conversions

Final Thoughts

2025 is shaping up to be a fantastic year for earning passive crypto income—whether you’re staking, running nodes, or diving into DeFi. The key is diversification: don’t put all your assets into one strategy. Instead, combine several approaches that suit your risk tolerance and level of involvement.

As always, do your own research (DYOR), assess the risks, and never invest more than you can afford to lose.